Unlocking Opportunities with Mini Forex Trading: A Comprehensive Guide

The foreign exchange (forex) market is the world’s largest and most liquid financial market, with trillions of dollars changing hands daily. While traditionally dominated by large institutions and high-net-worth individuals, the advent of mini forex trading has democratized access, allowing retail traders with smaller capital to participate. This comprehensive guide explores the world of mini forex, examining its benefits, risks, strategies, and how it compares to standard forex trading.

What is Mini Forex Trading?

Mini forex trading involves trading currency pairs in smaller lot sizes than standard forex trading. A standard lot in forex represents 100,000 units of the base currency, which can be a significant financial commitment for many traders. A mini forex lot, on the other hand, represents 10,000 units of the base currency. This smaller lot size significantly reduces the capital required to open a position, making forex trading more accessible to a wider range of individuals. [See also: Forex Trading for Beginners]

Benefits of Mini Forex Trading

- Lower Capital Requirements: The primary advantage of mini forex is the reduced capital needed to start trading. With smaller lot sizes, traders can control positions with less money, making it ideal for beginners or those with limited funds.

- Risk Management: Mini forex allows for better risk management. Traders can limit their potential losses by trading smaller positions, reducing the impact of adverse market movements. This is crucial for preserving capital and avoiding significant financial setbacks.

- Learning Opportunity: Mini forex provides a low-risk environment for learning the intricacies of forex trading. New traders can experiment with different strategies, indicators, and currency pairs without risking a substantial amount of capital. This hands-on experience is invaluable for developing trading skills.

- Flexibility: Mini forex offers greater flexibility in position sizing. Traders can fine-tune their positions to match their risk tolerance and account size, allowing for more precise control over their trading.

- Accessibility: Due to the lower capital requirements, mini forex is more accessible to a broader range of individuals. This democratization of forex trading empowers retail traders to participate in the global currency market.

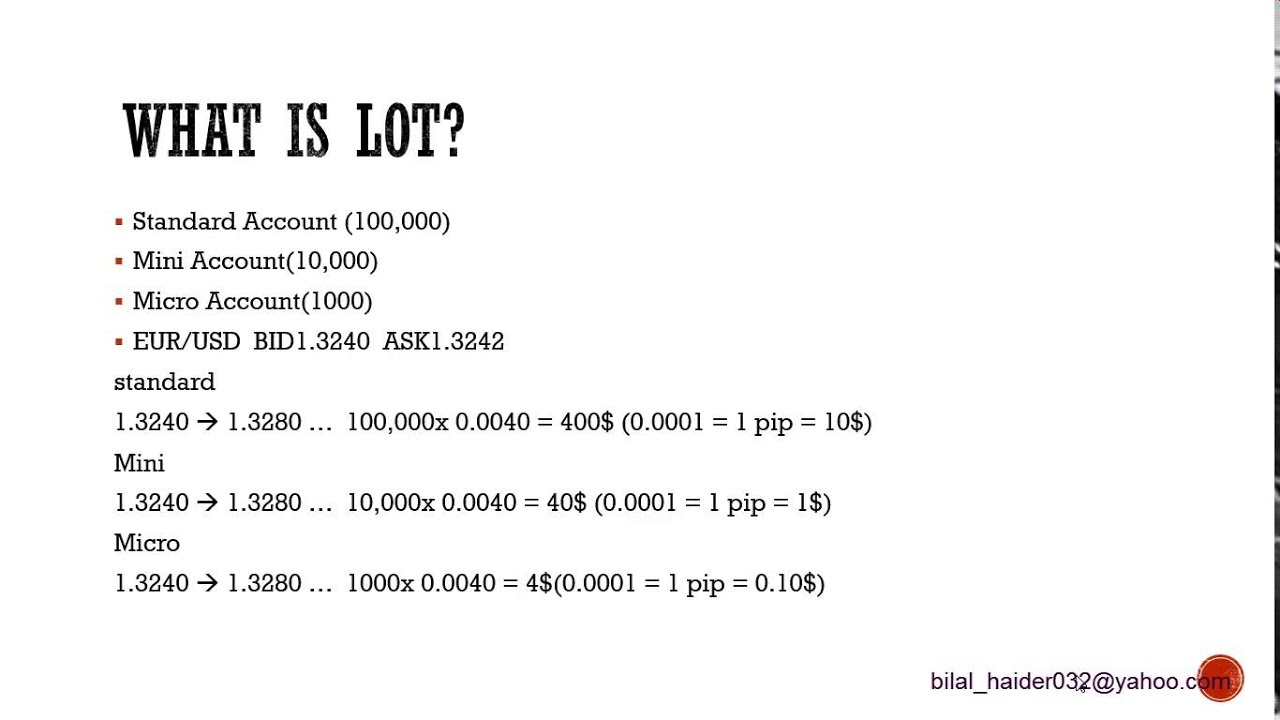

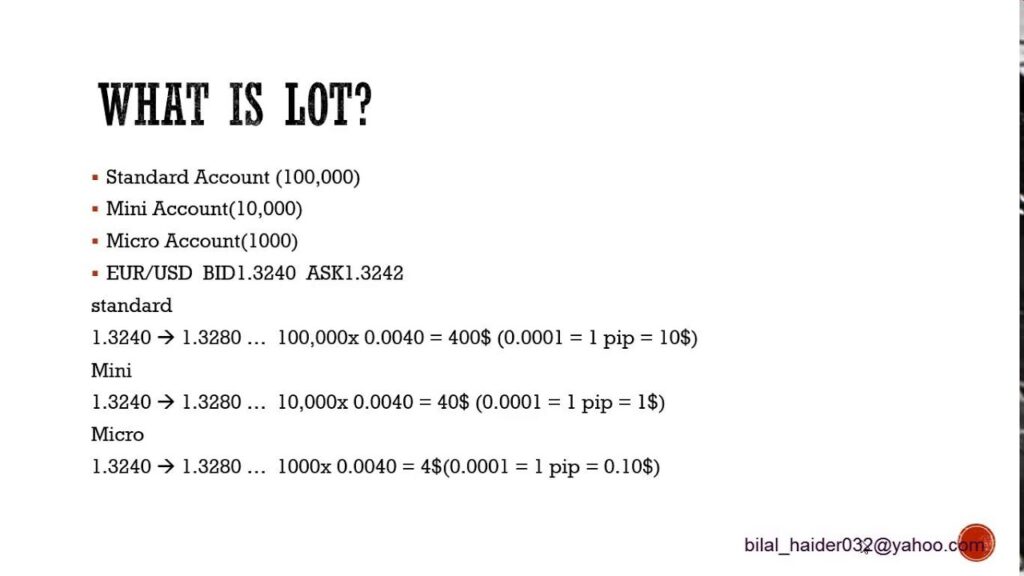

Understanding Forex Lot Sizes: Standard, Mini, Micro, and Nano

To fully grasp the significance of mini forex, it’s essential to understand the different lot sizes available in forex trading:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units of the base currency.

- Micro Lot: 1,000 units of the base currency.

- Nano Lot: 100 units of the base currency.

The choice of lot size depends on the trader’s risk tolerance, account size, and trading strategy. While standard lots offer the potential for higher profits, they also carry a higher risk. Mini forex lots provide a balance between risk and reward, making them a popular choice for many traders.

Strategies for Mini Forex Trading

Successful mini forex trading requires a well-defined strategy. Here are some popular strategies that traders can employ:

Trend Following

Trend following involves identifying and trading in the direction of the prevailing trend. Traders use technical indicators such as moving averages, trendlines, and the Relative Strength Index (RSI) to identify trends and enter positions accordingly. In mini forex, trend following can be a conservative strategy, allowing traders to capitalize on established market movements with controlled risk.

Breakout Trading

Breakout trading involves identifying price levels where the market is likely to break out of a consolidation pattern. Traders look for areas of support and resistance and enter positions when the price breaks through these levels. In mini forex, breakout trading can be a high-reward strategy, but it also carries a higher risk due to the potential for false breakouts. [See also: Understanding Support and Resistance Levels]

Scalping

Scalping is a short-term trading strategy that involves making small profits from minor price movements. Scalpers typically hold positions for only a few seconds or minutes, aiming to accumulate small gains throughout the day. Mini forex can be suitable for scalping due to the lower capital requirements and the ability to quickly enter and exit positions. However, scalping requires discipline, speed, and a high level of concentration.

Range Trading

Range trading involves identifying currency pairs that are trading within a defined range and buying at the lower end of the range and selling at the higher end. Traders use oscillators such as the RSI and Stochastic Oscillator to identify overbought and oversold conditions within the range. Mini forex can be used for range trading, allowing traders to profit from predictable price fluctuations within a defined range.

Risks of Mini Forex Trading

While mini forex offers several benefits, it’s essential to be aware of the risks involved:

- Leverage: Forex trading involves leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses. Mini forex traders must understand the risks of leverage and use it responsibly.

- Volatility: The forex market is highly volatile, and prices can fluctuate rapidly. Unexpected news events, economic data releases, and geopolitical tensions can all cause significant price swings. Mini forex traders must be prepared for volatility and have a risk management plan in place.

- Market Complexity: The forex market is complex and influenced by a multitude of factors. Understanding economic indicators, central bank policies, and global events is crucial for successful trading. Mini forex traders must continuously educate themselves and stay informed about market developments.

- Broker Risk: Choosing a reputable and regulated forex broker is essential. Unregulated brokers may engage in unethical practices, putting traders’ capital at risk. Mini forex traders should thoroughly research potential brokers and choose one that is licensed and regulated by a reputable authority.

Choosing a Mini Forex Broker

Selecting the right mini forex broker is crucial for a successful trading experience. Here are some factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a reputable authority such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

- Trading Platform: Choose a broker that offers a user-friendly and reliable trading platform. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers. Lower spreads and commissions can significantly reduce trading costs.

- Leverage: Consider the leverage offered by the broker. Choose a leverage level that aligns with your risk tolerance and trading strategy.

- Customer Support: Ensure that the broker provides responsive and helpful customer support.

- Account Types: Check if the broker offers mini forex accounts or accounts with micro lot trading options.

Mini Forex vs. Standard Forex: Key Differences

While both mini forex and standard forex involve trading currency pairs, there are key differences between the two:

- Lot Size: The primary difference is the lot size. Mini forex uses 10,000 unit lots, while standard forex uses 100,000 unit lots.

- Capital Requirements: Mini forex requires significantly less capital to start trading compared to standard forex.

- Risk: Mini forex offers lower risk due to the smaller lot sizes.

- Profit Potential: Standard forex has the potential for higher profits, but also carries a higher risk.

- Experience Level: Mini forex is often recommended for beginners, while standard forex may be more suitable for experienced traders.

Conclusion

Mini forex trading provides an accessible and manageable entry point into the world of forex trading. By offering smaller lot sizes and reduced capital requirements, it empowers retail traders to participate in the global currency market with greater control and flexibility. While risks are inherent in any form of trading, mini forex allows for better risk management and provides a valuable learning opportunity for those new to forex. By understanding the benefits, risks, and strategies associated with mini forex, traders can make informed decisions and potentially unlock new opportunities in the dynamic world of currency trading. Remember to choose a regulated broker, develop a solid trading plan, and continuously educate yourself to maximize your chances of success in the mini forex market. Always prioritize risk management and trade responsibly. The world of mini forex awaits, offering a chance to participate in the global financial landscape with prudence and potential.