Unlocking Mini Forex: A Comprehensive Guide to Small-Scale Currency Trading

The foreign exchange market, or Forex, is the largest and most liquid financial market in the world. While often associated with institutional investors and high-net-worth individuals, the advent of mini forex trading has democratized access, allowing retail traders to participate with significantly smaller capital outlays. This guide provides a comprehensive overview of mini forex, its benefits, risks, and how to get started.

What is Mini Forex?

Mini forex trading involves trading currency pairs in smaller lot sizes than standard forex trading. A standard lot represents 100,000 units of the base currency, while a mini forex lot represents 10,000 units. This reduction in lot size significantly lowers the financial barrier to entry, making forex trading accessible to a broader audience.

The core principle remains the same as standard forex trading: speculating on the price movements of currency pairs. Traders aim to profit from the difference between the buying and selling prices. However, with mini forex, the potential profit and loss are proportionally smaller, aligning with the reduced capital investment.

Benefits of Mini Forex Trading

- Lower Capital Requirements: This is the most significant advantage. Mini forex allows traders to start with as little as $100, making it an attractive option for beginners or those with limited capital.

- Risk Management: Smaller lot sizes enable better risk management. Traders can control their exposure and potential losses more effectively.

- Learning Opportunity: Mini forex provides a low-pressure environment to learn the intricacies of forex trading, including technical analysis, fundamental analysis, and trading psychology.

- Accessibility: Many online brokers offer mini forex accounts, making it easy to get started.

- Flexibility: Traders can experiment with different trading strategies and currency pairs without risking substantial capital.

Risks of Mini Forex Trading

While mini forex offers several advantages, it’s crucial to understand the inherent risks associated with forex trading in general:

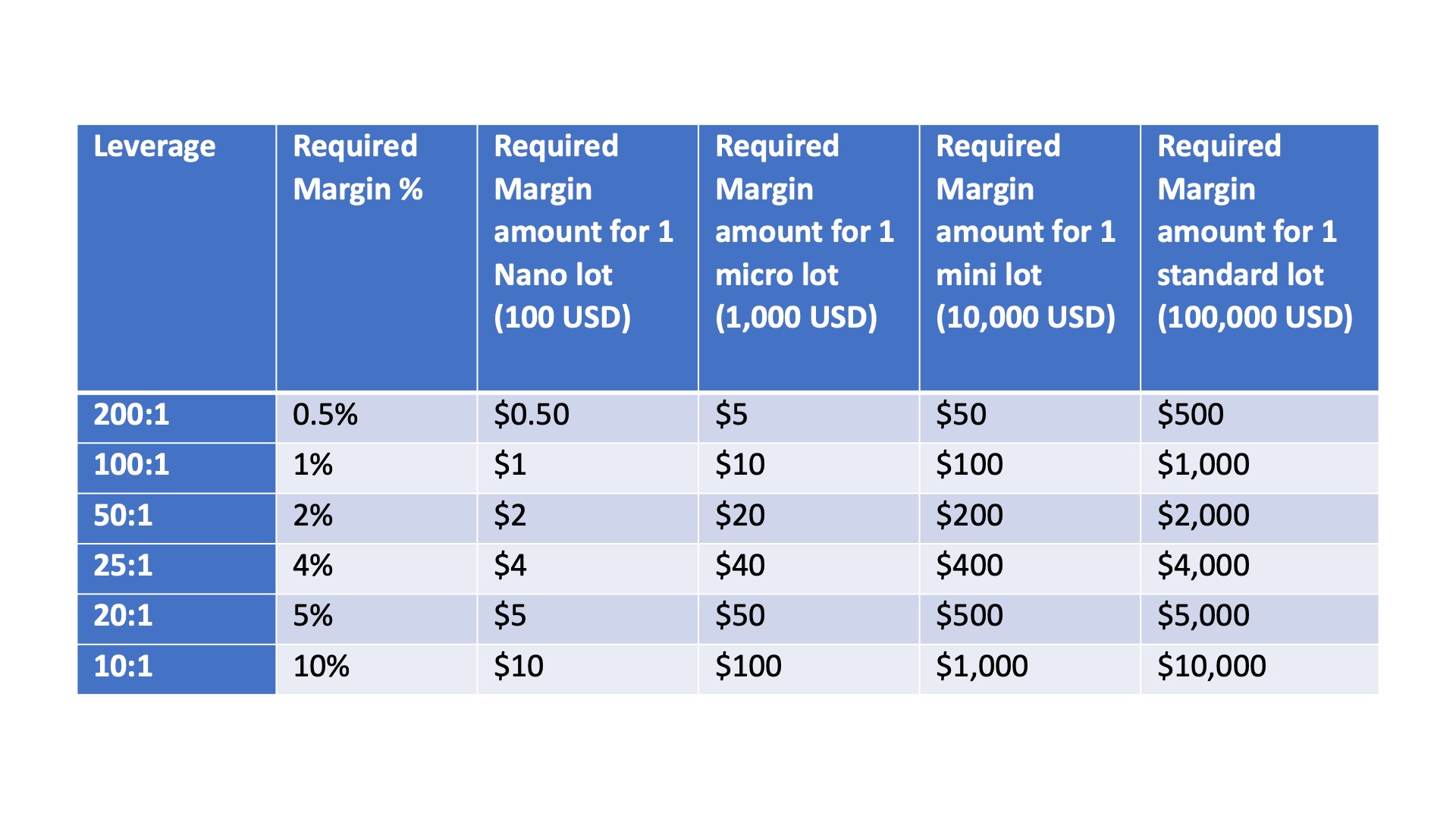

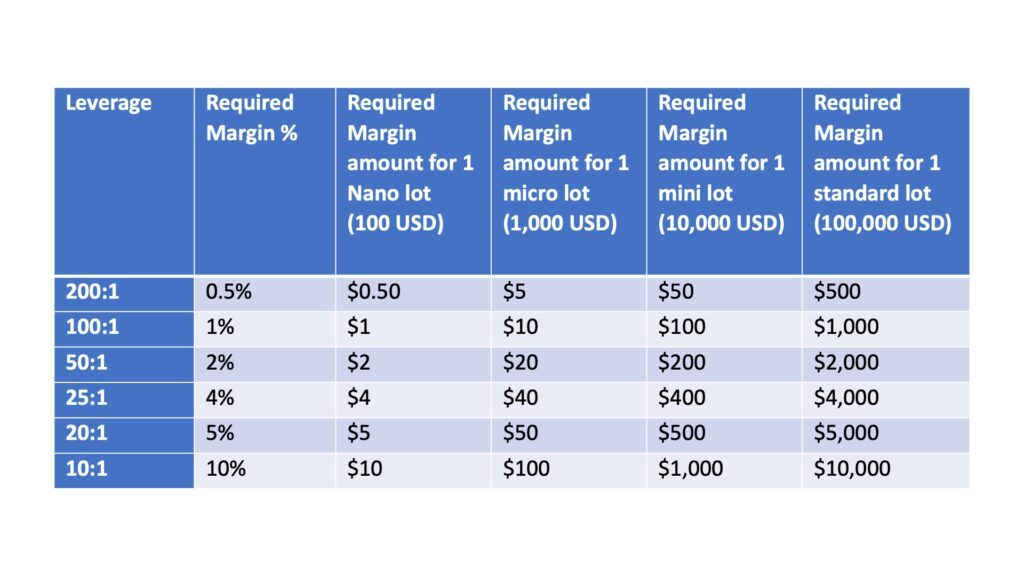

- Leverage: Forex trading involves leverage, which can amplify both profits and losses. While leverage can be beneficial, it’s essential to use it cautiously and understand its implications. Over-leveraging is a common mistake among beginner traders.

- Market Volatility: The forex market is highly volatile, and prices can fluctuate rapidly. Unexpected news events, economic data releases, and geopolitical tensions can all impact currency values.

- Lack of Regulation: Not all forex brokers are regulated, which can increase the risk of fraud or mismanagement of funds. It’s crucial to choose a reputable and regulated broker.

- Emotional Trading: Fear and greed can cloud judgment and lead to impulsive trading decisions. Developing a disciplined trading plan and sticking to it is essential for success.

- Limited Profit Potential: While smaller losses are a benefit, the potential for large gains is also reduced compared to standard forex trading.

Getting Started with Mini Forex

Here’s a step-by-step guide to getting started with mini forex trading:

- Education: Before risking any capital, invest time in learning the fundamentals of forex trading. Understand currency pairs, technical analysis, fundamental analysis, and risk management principles. Numerous online resources, courses, and books are available.

- Choose a Broker: Select a reputable and regulated forex broker that offers mini forex accounts. Consider factors such as trading platform, spreads, commissions, customer support, and regulatory compliance. Research and compare different brokers before making a decision.

- Open a Demo Account: Most brokers offer demo accounts that allow you to practice trading with virtual money. This is an excellent way to familiarize yourself with the trading platform and test different strategies without risking real capital.

- Develop a Trading Plan: Create a detailed trading plan that outlines your trading goals, risk tolerance, trading strategies, and money management rules. A well-defined trading plan will help you stay disciplined and avoid emotional trading.

- Fund Your Account: Once you’re comfortable with the trading platform and have a solid trading plan, fund your account with the amount you’re willing to risk. Remember to start small and gradually increase your trading size as you gain experience and confidence.

- Start Trading: Begin trading mini forex using your trading plan. Monitor your trades closely and adjust your strategy as needed. Keep a trading journal to track your progress and identify areas for improvement.

Key Considerations for Mini Forex Traders

- Risk Management: Emphasize risk management techniques, such as setting stop-loss orders and using appropriate position sizes. Never risk more than you can afford to lose.

- Trading Psychology: Develop emotional control and avoid impulsive trading decisions. Stick to your trading plan and don’t let fear or greed influence your judgment.

- Market Analysis: Stay informed about market news and economic events that can impact currency values. Use technical analysis and fundamental analysis to identify potential trading opportunities.

- Continuous Learning: The forex market is constantly evolving, so it’s essential to continue learning and adapting your strategies. Attend webinars, read books, and follow reputable financial news sources.

- Patience: Forex trading requires patience and discipline. Don’t expect to get rich quick. Focus on consistent profits over the long term.

The Future of Mini Forex

Mini forex is likely to continue to grow in popularity as more retail traders seek access to the forex market. Technological advancements, such as mobile trading platforms and automated trading systems, are making it easier than ever to participate in mini forex trading. As the market becomes more accessible, it’s crucial for traders to prioritize education, risk management, and disciplined trading practices.

Conclusion

Mini forex provides a valuable opportunity for individuals to participate in the foreign exchange market with lower capital requirements and controlled risk. However, it’s essential to approach mini forex trading with a solid understanding of the risks involved and a well-defined trading plan. By prioritizing education, risk management, and disciplined trading practices, traders can increase their chances of success in the dynamic world of mini forex.

Remember to always consult with a financial advisor before making any investment decisions. Trading forex involves risk and you can lose money.

[See also: Forex Trading for Beginners] [See also: Risk Management in Forex] [See also: Choosing a Forex Broker]